Construction Update – June 2021

To Build, or Not to Build, that is the question!

A scarcity of single-family home inventory combined with record low interest rates, have led to an unprecedented housing boom and surging home prices. It is a sellers-market to be sure. The millennial generation is growing up and ready to leave apartment life. In addition, the emergence of the work-from-home trend has many looking for more economical space in their homes and the desire to leave city life. Of course, the big driver in all of this activity is the low interest rate environment.

Surging lumber prices, (up as much as 400% since January 2020), supply chain issues, and labor shortages lead many in the industry to believe that home prices will not be falling in the near future. While lumber futures have started to trend down, forecasters expect lumber prices to remain elevated through 2022.

So, what does all of this mean for our potential customers? Do you go forward with plans to build a new home, despite the higher prices? Or do you wait to build your new home, expecting prices to drop to pre-pandemic levels? What about interest rates? As of the writing of this article, 30-year mortgage rates (for a credit score of 680-699) are at 2.5%. Just 2 short years ago 30-year mortgage rates were at 4% – and we thought that was low! While the price of our product has increased for all of the reasons noted above, the effect on monthly mortgage payments has been minimal due to these very low interest rates. For example, an increase of $35,000 to the base price of one of our houses, equates to an extra $139 in your monthly mortgage costs ($35,000 @2.5% over 30 years).

With no foreseeable drop in housing prices, there is talk that mortgage rates could rise to combat inflation. While higher rates may lead to less demand and therefore more stable housing prices, it could also mean higher mortgage payments for our customers.

What are you betting on in the housing market?

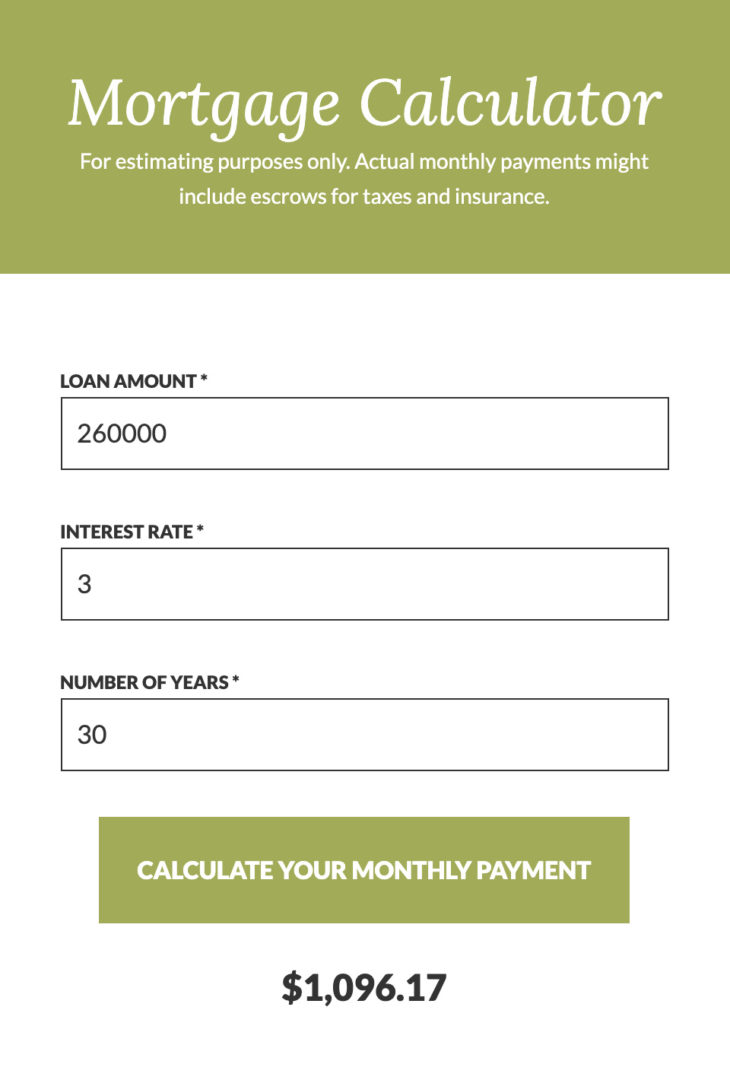

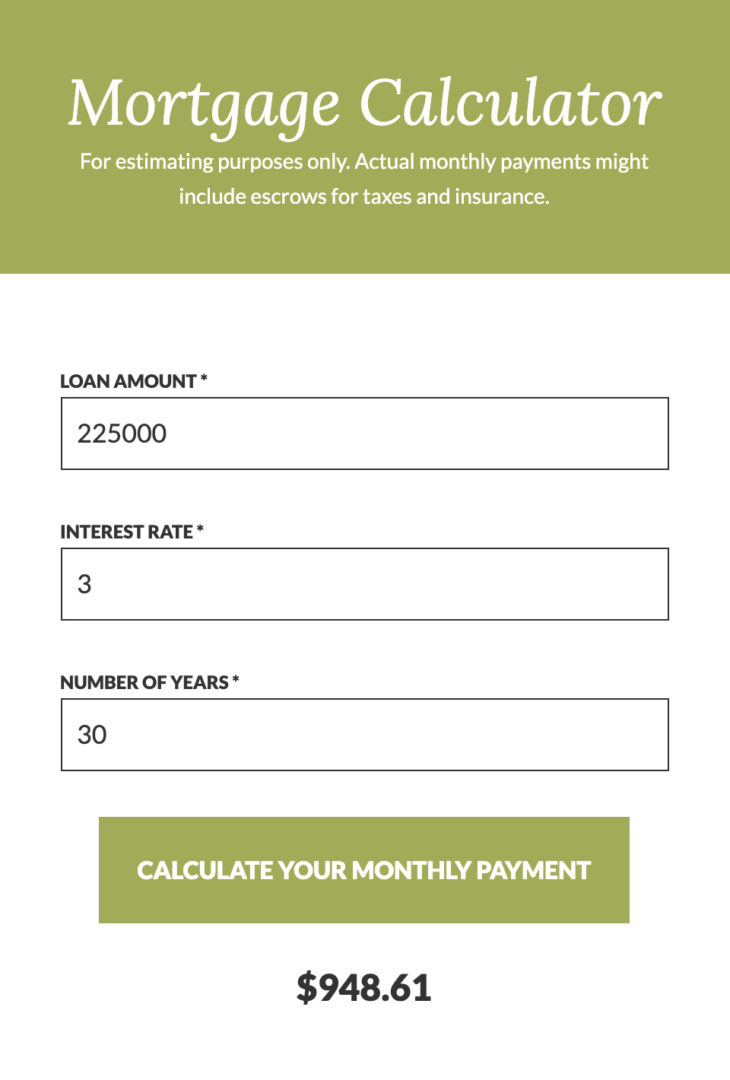

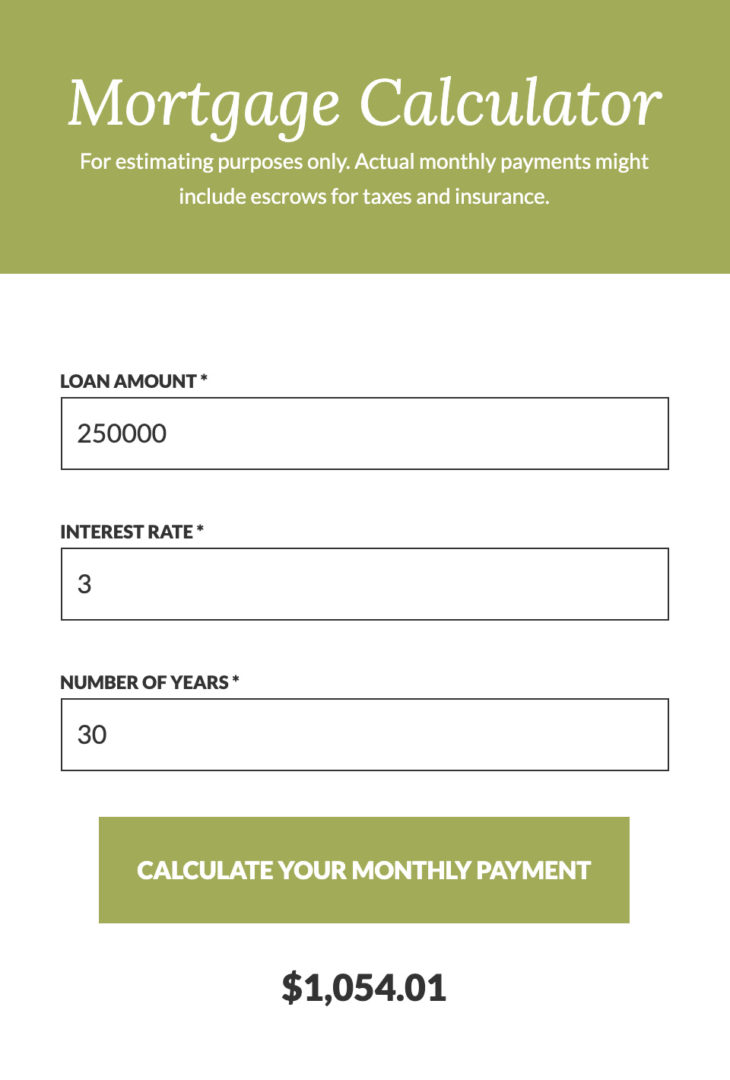

Below are a few scenarios to consider when you are trying to decide when to build and just what you can afford. It also shows you the power of a low interest rate environment. Note that the Loan Amount for Scenario 1 is $260,000 (to reflect current pricing), while the Loan Amount for Scenario 2 fluctuates between $225,000 (to reflect pre-pandemic pricing) and $250,000 (assumes a slight drop in pricing over time). In the final example, the Loan Amount is the same for both Scenarios – $260,000, as it assumes that home prices do not fall.

Comparison 1: Build now at current pricing versus wait for prices to stabilize assuming interest rates won’t increase as you wait.

SCENARIO 2: WAIT FOR HOUSING PRICES TO STABILIZE

Assumes interest rates won’t increase as you wait.

*Scenario 2 assumes rates stay the same AND that housing prices fall to pre-pandemic levels.

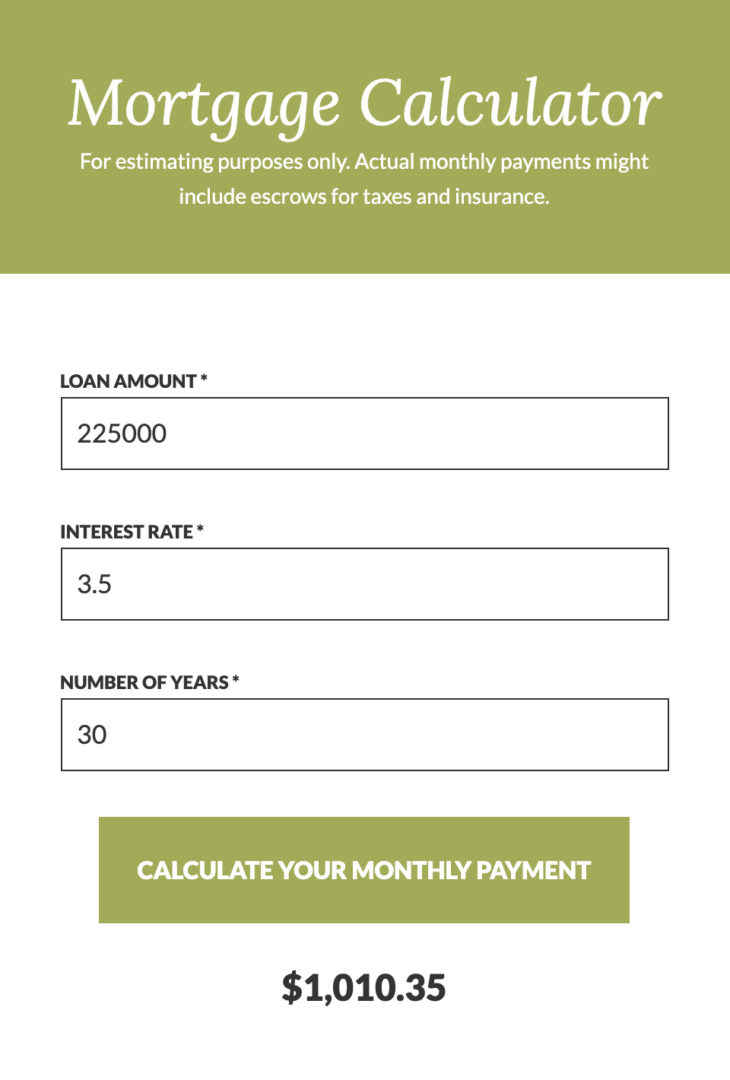

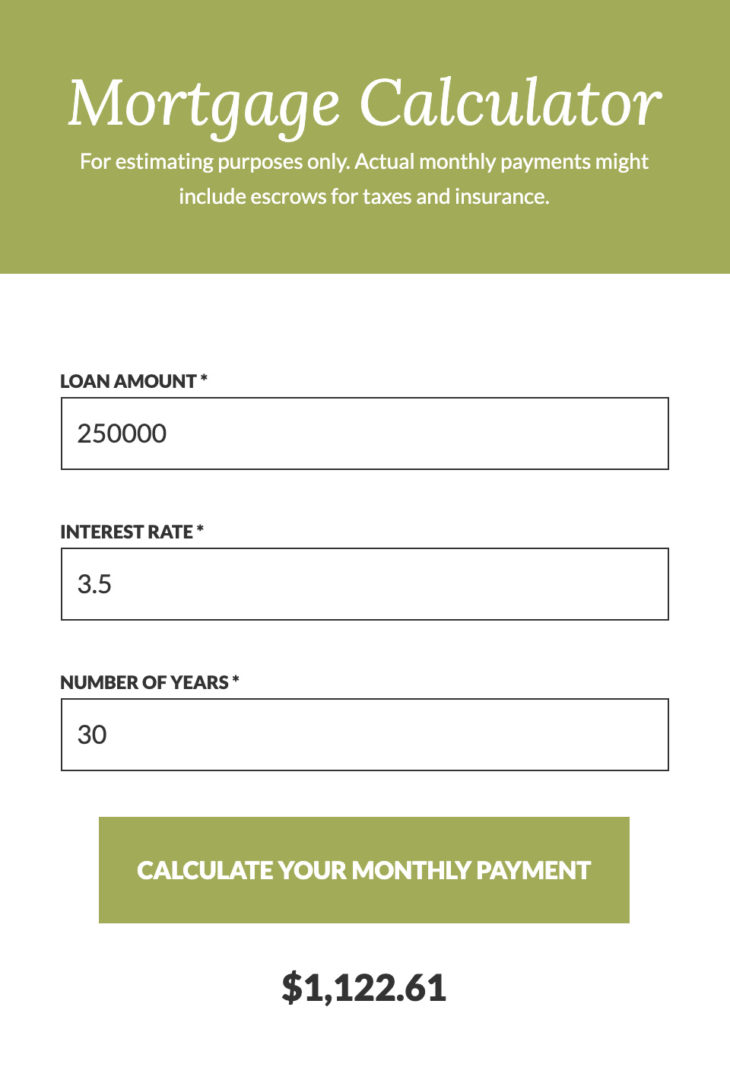

COMPARISON 2: BUILD NOW AT CURRENT HOME PRICING VERSUS WAIT FOR PRICES TO STABILIZE WITH THE CHANCE THAT INTEREST RATES WILL INCREASE AS YOU WAIT.

SCENARIO 2: WAIT FOR HOUSING PRICES TO STABILIZE

Chance that housing interest rates will increase as you wait.

*Scenario 2 assumes rates increase by .05% to stave off inflation – AND – housing prices fall to pre-pandemic levels.

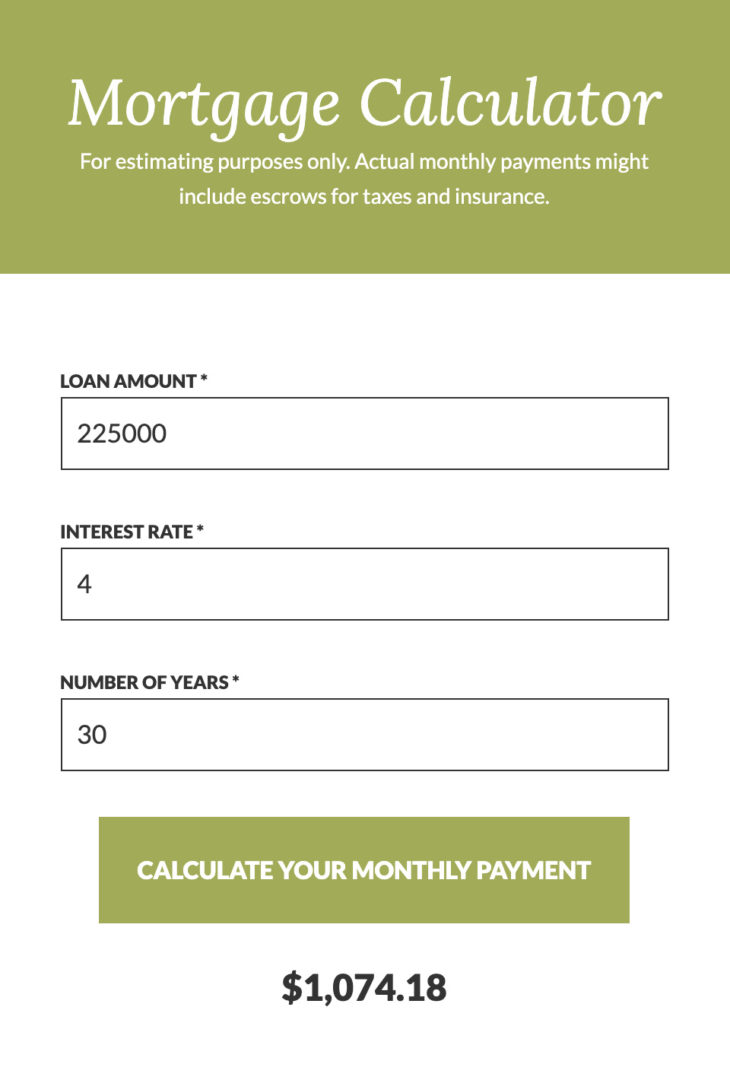

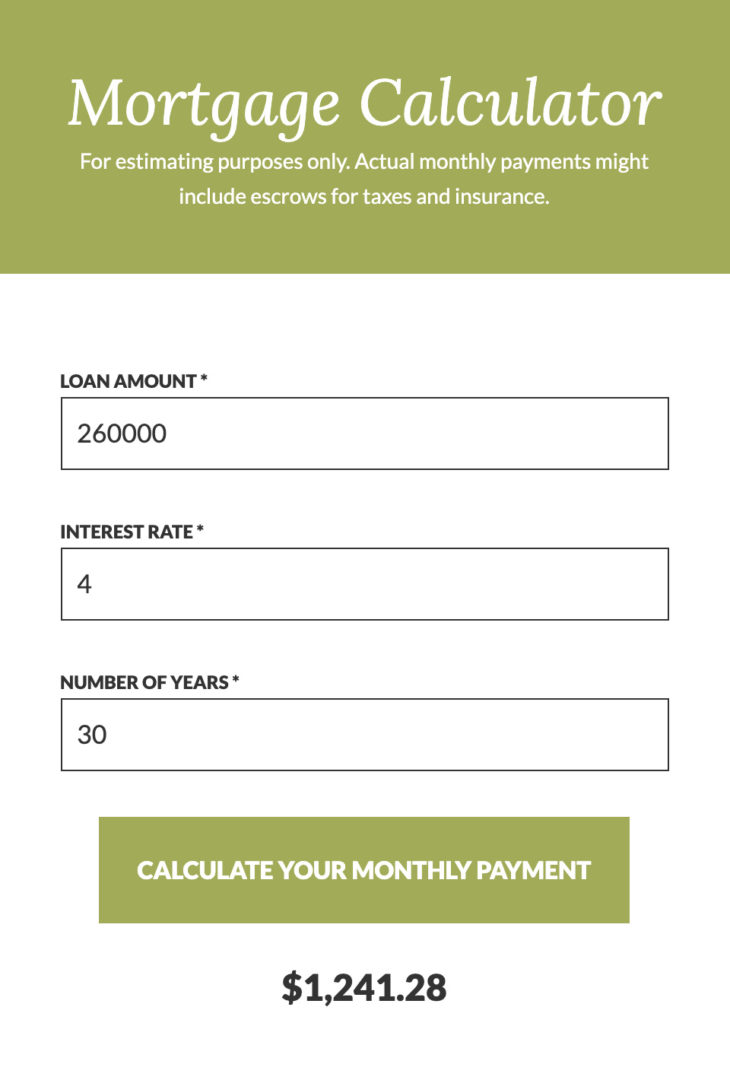

COMPARISON 3: BUILD NOW AT CURRENT HOME PRICING VERSUS WAIT FOR HOUSING PRICES TO STABILIZE AS RATES JUMP TO 1% WHILE WAITING.

SCENARIO 2: WAIT FOR HOUSING PRICES TO STABILIZE

Rates jump by 1% while you wait.

*Scenario 2 assumes housing interest rate increase by 1% to stave off inflation – AND – housing prices fall to pre-pandemic levels.

COMPARISON 4: BUILD NOW AT CURRENT HOME PRICING VERSUS PRICING DECREASES BY $10,000 AND RATES STAY THE SAME.

SCENARIO 2: PRICING COMES DOWN $10,000

Housing interest rates stay the same

COMPARISON 5: BUILD NOW AT CURRENT HOME PRICING VERSUS PRICING DECREASES BY $10,000 AND INTEREST RATES STAY THE SAME.

SCENARIO 2: PRICING COMES DOWN $10,000

Interest rates stay the same

*Scenario 2 assumes rate increase by .05% to stave off inflation – AND – housing prices fall by $10,000 over time.

COMPARISON 6: BUILD AT CURRENT PRICING VERSUS HOUSING PRICES STAY WHERE THEY ARE WHILE INTEREST RATES INCREASE BY 1% WHILE WAITING.

SCENARIO 2: HOUSING PRICES STAY WHERE THEY ARE

Interest rates jump by 1% while you wait.

*Scenario 2 assumes rates increase by 1% to stave off inflation – AND – housing prices do not fall back to pre-pandemic levels.

Comparison 6 outcome: Monthly Mortgage payment increases by $145.11

Note: Any increase in rates without a signifiant drop in the pricing, will create higher monthly mortgage payments.

What shift in the housing market are you betting on that is preventing you from building your new home?

As you can see in the situations above, building your new NC or SC home with current pricing on homes and while interest rates are low saves you money in the long term. Learn more about building your new family home with Madison Homebuilders and download our home plan book for ideas.